Starting the year off on the right financial foot can set the tone for the rest of the year, right? One way to do this is by creating a budget, which can help you keep track of your income and expenses and make sure you are saving and spending wisely. There are many tools and resources available to help you create and stick to a budget and with that, it will keep you on track towards to your financial goals.

Budgeting is the process of creating a plan to manage your money, setting financial goals, and tracking your spending. By creating a budget, you can take control of your finances and make the most of your income. There are many benefits to budgeting, including:

Budgeting is the process of creating a plan to manage your money, setting financial goals, and tracking your spending. By creating a budget, you can take control of your finances and make the most of your income. There are many benefits to budgeting, including:

• Improved financial stability. A budget helps you understand where your money is going, so you can make sure you have enough to cover your expenses and save for the future.

• Greater control over your money. By setting financial goals and tracking your spending, you can make more informed decisions about how to use your money.

• Reduced stress. When you have a budget, you're less likely to worry about money and feel more in control of your financial situation.

• Increased savings. By setting aside money for emergencies and long-term goals, you can build a stronger financial foundation for the future.

|

| Budgeting 101: A Guide to Getting Your Finances in Order for the New Year |

To create a budget, start by listing your income and all your regular expenses, such as rent, utilities, and debts. Next, set financial goals and determine how much you can afford to save each month. Then, track your spending and make adjustments as needed to stay on track.

One common mistake people make when budgeting is failing to account for unexpected expenses. It's important to set aside money for things like car repairs or medical bills, so you don't overspend and go into debt when these expenses arise.

With that having said, here are some tips to help you budget and start the year one step closer to your financial goals:

The first step in creating a budget is to determine your income and expenses. Make a list of all your regular income sources and all your recurring expenses, such as rent, utilities, groceries, and debts.

Having specific financial goals can help motivate you to stick to your budget. These might include saving for a down payment on a house, paying off debt, or building an emergency fund.

Look for ways to reduce your expenses. For example, you might be able to negotiate lower rates for your bills or cut back on non-essential purchases. To know what really got expensive and cheaper this year (in time of inflation), check this article from CNN News.

Use a budgeting app or create a spreadsheet to track your income and expenses. This will help you see where your money is going and identify areas where you can cut back. In an era where everything is kind of expensive, this tip is very important.

Set aside money in your budget for unexpected expenses, such as car repairs or medical bills. This will help you avoid overspending and going into debt when unexpected expenses arise.

Your budget is a living document, so be sure to review and adjust it as needed. This will help you stay on track and reach your financial goals.

Using cash can help you stick to your budget by making you more aware of your spending. Consider using the envelope budgeting method, where you assign a set amount of cash to different categories of expenses and only spend what you have allocated for that category.

It's important to set aside money for emergencies and long-term goals. Determine how much you can afford to save each month and set up automatic transfers to a savings account.

There are many budgeting and personal finance apps available that can help you track your spending and find ways to save. These tools can be especially useful for tracking expenses on the go.

If you're having trouble sticking to a budget or achieving your financial goals, consider seeking the advice of a financial planner or counselor. They can help you develop a personalized budget and financial plan that works for you.

To sum it up, budgeting is a powerful tool that can help you take control of your finances, reduce stress, and achieve your financial goals. By creating a budget and tracking your spending, you can make the most of your income and build a stronger financial foundation for the future.

With that having said, here are some tips to help you budget and start the year one step closer to your financial goals:

|

| More details on wwww.nedobrien.com. |

Determine your income and expenses.

The first step in creating a budget is to determine your income and expenses. Make a list of all your regular income sources and all your recurring expenses, such as rent, utilities, groceries, and debts.

Set financial goals

Having specific financial goals can help motivate you to stick to your budget. These might include saving for a down payment on a house, paying off debt, or building an emergency fund.

Cut unnecessary expenses

Look for ways to reduce your expenses. For example, you might be able to negotiate lower rates for your bills or cut back on non-essential purchases. To know what really got expensive and cheaper this year (in time of inflation), check this article from CNN News.

|

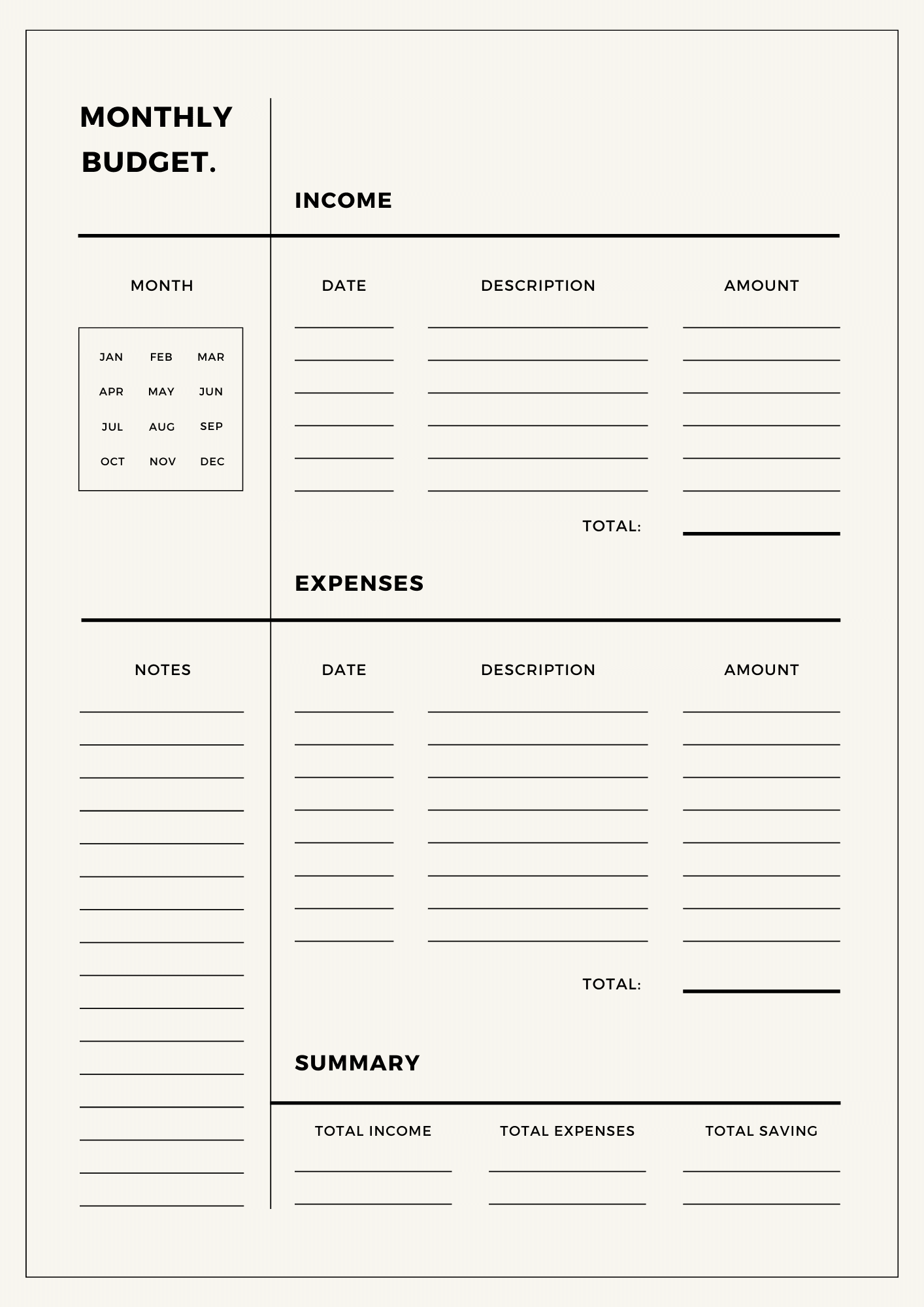

| a budget planner to keep you on track |

Keep track of your spending

Use a budgeting app or create a spreadsheet to track your income and expenses. This will help you see where your money is going and identify areas where you can cut back. In an era where everything is kind of expensive, this tip is very important.

Plan for unexpected expenses

Set aside money in your budget for unexpected expenses, such as car repairs or medical bills. This will help you avoid overspending and going into debt when unexpected expenses arise.

Review and adjust your budget regularly

Your budget is a living document, so be sure to review and adjust it as needed. This will help you stay on track and reach your financial goals.

Use cash instead of credit

Using cash can help you stick to your budget by making you more aware of your spending. Consider using the envelope budgeting method, where you assign a set amount of cash to different categories of expenses and only spend what you have allocated for that category.

Make a savings plan

It's important to set aside money for emergencies and long-term goals. Determine how much you can afford to save each month and set up automatic transfers to a savings account.

Use technology to your advantage

There are many budgeting and personal finance apps available that can help you track your spending and find ways to save. These tools can be especially useful for tracking expenses on the go.

Seek professional advice

If you're having trouble sticking to a budget or achieving your financial goals, consider seeking the advice of a financial planner or counselor. They can help you develop a personalized budget and financial plan that works for you.

To sum it up, budgeting is a powerful tool that can help you take control of your finances, reduce stress, and achieve your financial goals. By creating a budget and tracking your spending, you can make the most of your income and build a stronger financial foundation for the future.

|

| More details on www.nedobrien.com. |

.jpg)

.jpg)

.JPG)

.jpg)

Post a Comment